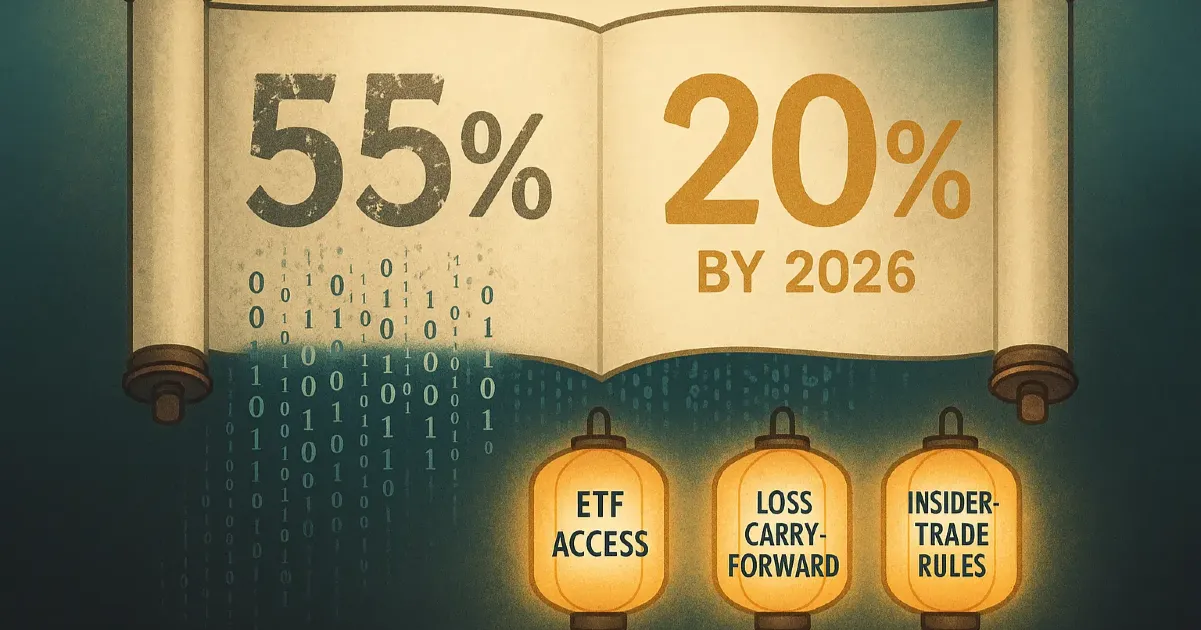

Japan plans a crypto tax overhaul: 55% rate cut to 20% with loss carry-forwards.

From Punishing to Pragmatic: A Tax Shift on the Horizon

Japan’s old crypto tax regime had one glaring flaw: it was excessively punitive. Investors who made gains on digital assets faced a steep top effective tax rate of up to 55%. That made crypto trading far less appealing than conventional markets, where capital gains top out at just 20%. This imbalance discouraged innovation and pushed digital asset investors out of Japan.

Now, that’s set to change. In a big policy turnaround, Japan’s governing Liberal Democratic Party (LDP) and Financial Services Agency (FSA) have proposed a sweeping overhaul that would cut the crypto tax rate to a flat 20%, leveling the playing field with equities and signaling a pivotal shift toward becoming a Web3 innovation hub.

A New Tax Era: Flat Rate and Institutional Fairness

If passed, the reform officially launches in fiscal year 2026. It entails:

- A 20% flat tax on profits from crypto trades, staking, airdrops, NFT sales, and more, replacing the complicated progressive rate structure.

- Loss carry-forward provisions that allow traders to offset crypto losses for up to three years—a feature long absent in the digital asset space.

- Equity-style market protections, including insider-trading regulations, bring more transparency and investor safety to crypto markets.

These shifts transform crypto from a heavily taxed "miscellaneous income" category into a recognized financial asset class.

Reclassification Under the Financial Instruments Act

Japan’s FSA isn’t stopping at tax reform. It also plans to reclassify cryptocurrencies under the Financial Instruments and Exchange Act (FIEA), the same framework governing stocks and bonds. That means tighter disclosure requirements, formal investor protections, and compliance rules previously unavailable to crypto issuers.

In practice, this move brings crypto in line with traditional securities, enabling the launch of regulated products like crypto ETFs and curbing market manipulation. The associated protections and clarity could mobilize institutional capital by early 2026.

What This Means for Investors and Exchanges

These reforms could shift Japan’s digital asset economy in meaningful ways:

- Token investors gain breathing room with tax predictability and loss buffers—essential tools in volatile markets.

- Institutions may step in now that crypto markets will support fair rules, insider protections, and formal access paths (think ETFs).

- Crypto services gain legitimacy. Exchanges, custodians, NFT platforms, and Web3 startups will likely benefit from formal legal recognition.

With over 12 million crypto accounts already active in Japan, these reforms are poised to unleash deeper participation and innovation.

Context: From Post-Hack Rigidity to Smart Regulation

Historically, Japan was known for stringent crypto oversight. Hacking scandals like Mt. Gox (2014) and Coincheck (2018) led to rigid rules under the Payment Services Act, heavy AML/KYC requirements, exchange licensing, and custody controls that leaned toward caution.

Today’s reforms are part of a larger recalibration. Rather than stifling innovation, Japan now aims to balance investor security with growth, welcoming Web3 frameworks while preserving transparency and fair markets.

Political Momentum Building

The LDP has been vocal about crypto’s role in modern investing. Finance Minister Katsunobu Katō emphasized that, although volatile, properly regulated digital assets could be a valuable portfolio component. These reforms also tie into the broader “New Capitalism” vision driving domestic investment, digital industry growth, and future-ready regulation.

Lawmakers have been nudged by rising retail demand and tech innovation. With over $34 billion held in crypto across Japanese accounts, the political will to adapt is stronger than ever.

Japan vs. Other Markets: A Global Comparison

When these reforms take effect, Japan could become one of the most attractive jurisdictions for crypto activity:

- Flat 20% tax aligns with the U.S. and U.K., contrasting sharply with the current 55% top rate in Japan.

- FIEA reclassification offers legal clarity seen in progressive markets like Switzerland or Singapore.

- Stable regulatory footing with a clear track for ETFs and tokenized products puts Japan ahead of other cautious economies.

Japan’s vision is to regain and boost its role as a global digital asset hub, synching tradition with tech progress.

What to Watch Next

- Will the FSA’s reclassification and loss carry-forward rules pass into law early in 2026?

- How will exchanges and institutional investors respond will they launch new ETFs or funds?

- Will the stablecoin ecosystem grow, especially given local yen-backed options and cross-border payments?

- How will these changes sway global crypto capital flows, especially from investors seeking regulated markets?

Conclusion: A Defining Moment for Japan’s Crypto Future

Japan is signaling a bold turn from tax burdens and cautious regulation to structured, supportive crypto policy. A flat 20% tax rate, multi-year loss offsets, and formal securities laws bring clarity that could attract both retail traders and institutional capital.

For a country that pioneered crypto-friendly law in 2017, this is the next evolutionary step, positioning Japan not just as compliant but as competitive in the global Web3 economy.